- Notcoin formed a bearish market structure after slipping below the range low.

- The 78.6% Fibonacci retracement level is the next price target.

The price of Notcoin [NOT] was beginning to trend downward once again. This was not good news for investors after the breakout past the trendline resistance on the 6th of July. The bearish pressure could erase the gains made earlier this month.

An earlier report noted that NOT had a bearish bias. Since then, the token has fallen below the short-term range lows and could be headed toward the local lows at $0.0099.

The Notcoin downtrend was gathering strength

Source: NOT/USDT on TradingView

Two weeks ago, NOT was trading within a range (purple) that extended from $0.0145 to $0.0175. In the past week, the crypto has posted a 15.8% price drop.

Additionally, the range low and the 61.8% retracement level at $0.014 were flipped to resistance.

The RSI was below neutral 50 to denote bearish momentum. The -DI crossed over above the +DI on the 23rd of July to signal a bearish trend was gathering strength.

The OBV has also been sliding lower in the past three weeks.

The steady selling pressure and the rising downward momentum suggested that Notcoin is likely to move to the $0.00989 support level in the coming days.

Futures sentiment is predominantly bearish

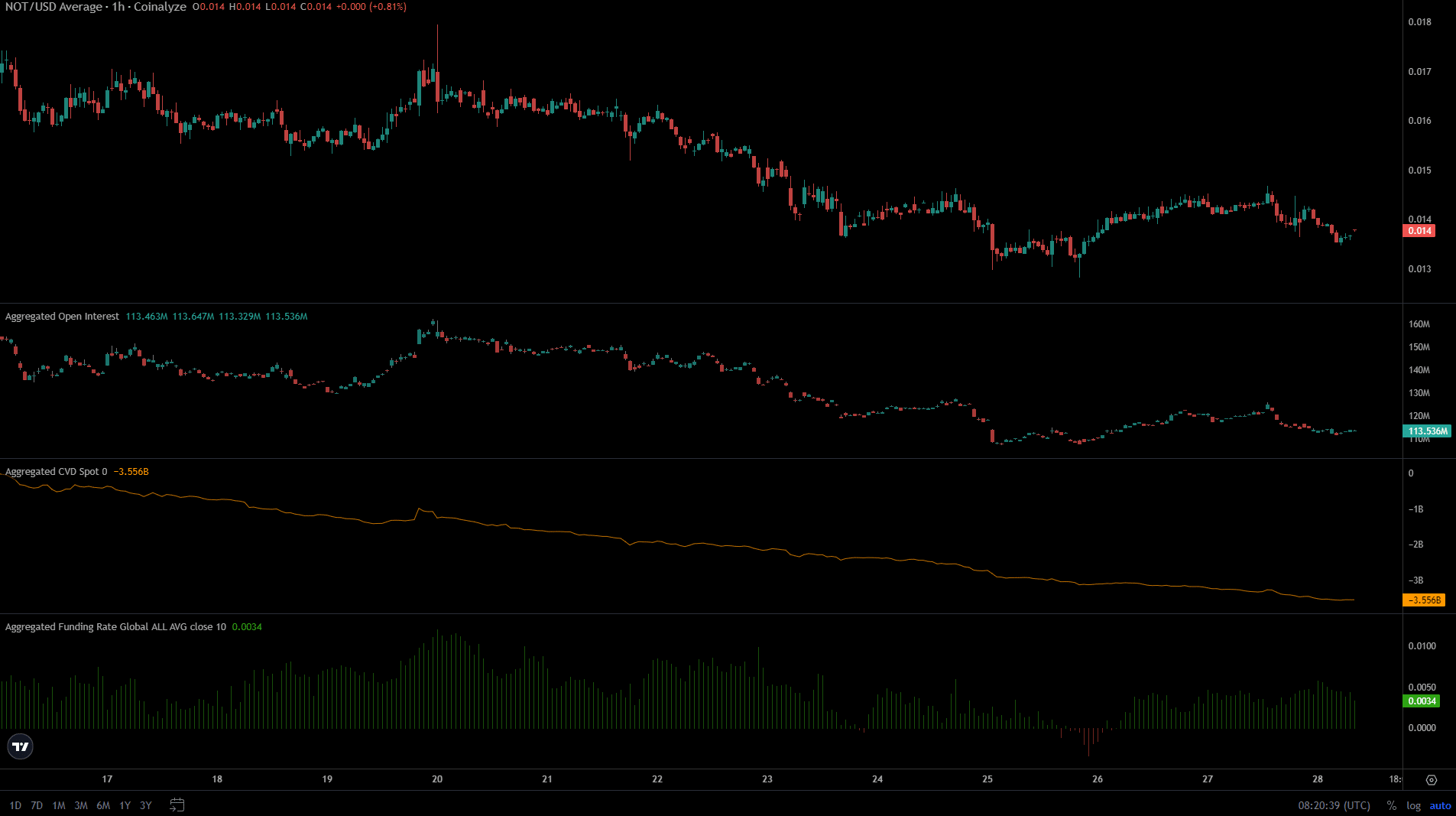

Source: Coinalyze

Since the 20th of July, both the price and the Open Interest of Notcoin have trended downward. There were minor bounces in both of them which lasted a few hours, but overall the trend signaled bearish sentiment.

Is your portfolio green? Check the Notcoin Profit Calculator

The spot CVD also continued to slump. This showed selling pressure had the upper hand. The funding rate was nominally bullish but does not foreshadow an upward price move.

Hence, traders can expect losses to continue for NOT.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.