- BTC maintained the $67,000 price range despite declines.

- The sentiment has also remained positive.

Bitcoin’s [BTC] price has experienced a downturn over the last 24 hours, yet the overall positive trend remains robust. This resilience is further underscored by the crypto fear and greed index, which currently reflects a positive sentiment in the market.

Bitcoin sees monthly high in weighted sentiment

The weighted sentiment for Bitcoin, as analyzed using Santiment data, has recently surged to its highest point in several months, currently standing at over 4.9. This marks a significant shift, as the sentiment had predominantly been negative since around May.

Analysis revealed a brief positive uptick around 15th July, but this was quickly followed by a return to negative values.

However, starting from approximately 23rd July, the sentiment began a consistent upward trajectory, culminating in the current high.

Source: Santiment

This is the highest level of weighted sentiment Bitcoin has experienced since March 2023, indicating a robust turnaround in market attitudes toward Bitcoin.

The rise also reflects increased investor confidence and positive market expectations.

Bitcoin shows greedy sentiment

The Bitcoin fear and greed index, as reported by Coinglass, currently stands at around 71, indicating a state of “greed.” This level reflects a significant degree of confidence among traders regarding the future trajectory of Bitcoin’s price.

Such confidence persists despite the cryptocurrency facing a price decline over the last 48 hours.

This index, which gauges the emotions and sentiments driving Bitcoin investors’ behavior, suggests that many traders remain optimistic about BTC’s potential for recovery and growth.

Also, they are likely buying into the market with the expectation that prices will rise. This optimistic sentiment aligns with the recent spike in the weighted sentiment indicator, both pointing to a generally bullish outlook in the market.

Bitcoin remains in a bull trend

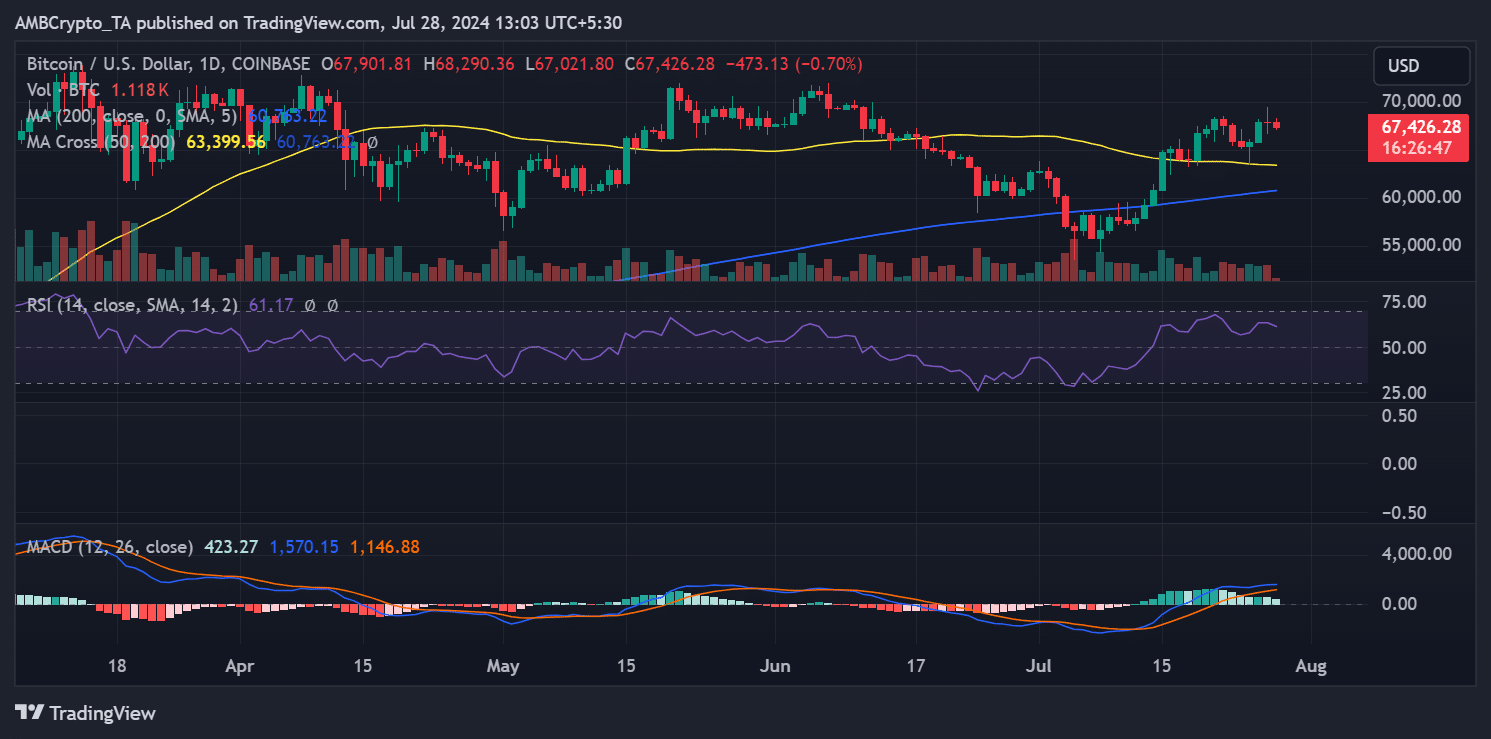

The Bitcoin price trend recently experienced a slight downturn but has managed to stay within the $67,000 range.

As of the latest updates, the price has continued to decline, although the decrease remained less than 1%, with BTC currently trading at around $67,425.

Despite these minor declines, it was still in a bullish trend. This is supported by its Relative Strength Index (RSI), which is currently at around 60, indicating a strong bullish momentum.

Source: TradingView

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, it was trading above its short-term moving average (depicted as the yellow line), which is acting as a support level around the $63,000 mark.

This alignment above the moving average further confirms the ongoing bullish trend, suggesting that Bitcoin still has strong market support at these levels.